About Us - The Bahamas Customs Department

As early as 1729 with the arrival of the first Royal Governor, Sir Woodes Rodgers, a collector of Customs was appointed. In an 1854 Act of Parliament, the Customs Department and Treasury Department, (the two (2) Major Collectors of Revenue), were one department under a Receiver General.

As early as 1729 with the arrival of the first Royal Governor, Sir Woodes Rodgers, a collector of Customs was appointed. In an 1854 Act of Parliament, the Customs Department and Treasury Department, (the two (2) Major Collectors of Revenue), were one department under a Receiver General.

On the 21st March, 1914, an Act was passed to establish a Customs Department separate and apart from the link with the Treasury Department. It was in this Act that the establishment of a Comptroller of Customs was commissioned. His duties were:

1. The general management and administration of the Customs Department.

2. The collection of all revenue due for any duties of Customs and payments to the Treasurer.

3. The active supervision of indoor and outdoor officers of the Customs Department.

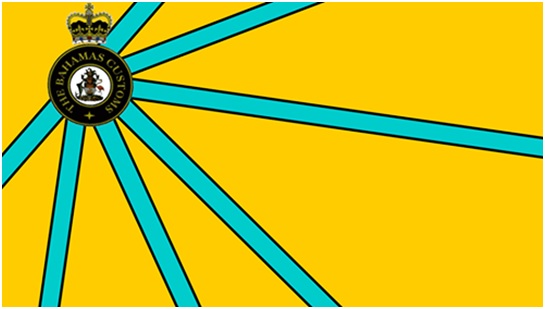

Her Majesty’s Customs Department’s name was later officially changed to The Bahamas Customs Department with the passage of the Customs Management Act 1976. In 1989 the Customs Regulations provided for the appointment of a customs seal and flag. The flag is designed with a gold background and the Customs Crest is in the top left corner with seven (7) blue stripes extending to the outer limits.

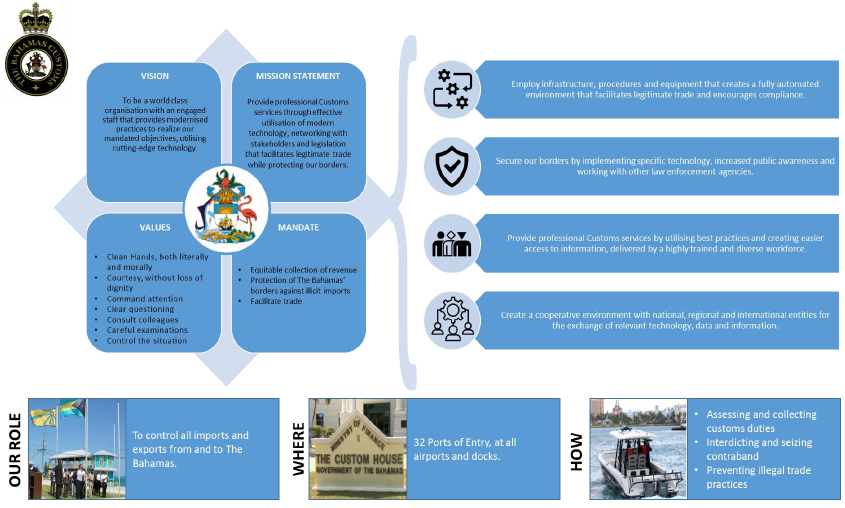

Our Role

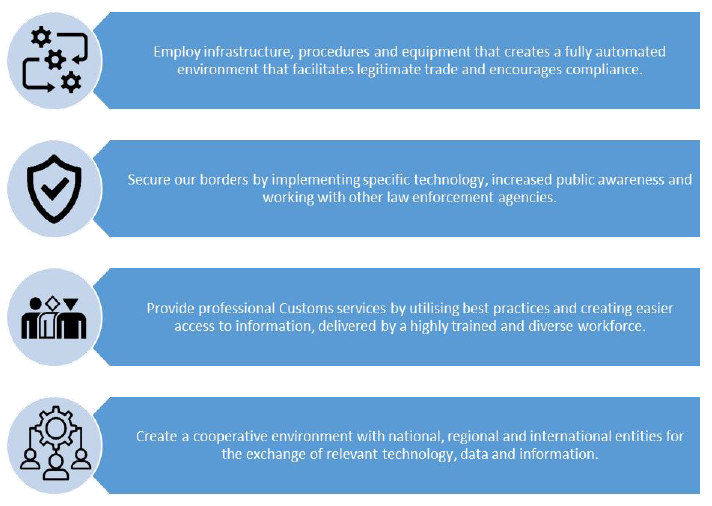

The key function of the Customs Department is the Collection and Protection of the Revenue of The Bahamas.

Currently, there are three specific mandates: The equitable collection of revenue, protection of The Bahamas’ borders against illicit imports and the facilitation of trade. The Customs Department carries out these functions by:

- Assessing and collecting customs duties, fees, and penalties due on imports;

- Interdicting and seizing contraband, including narcotics and illegal drugs;

- Processing passengers, baggage, cargo and mail;

- Detecting and apprehending persons engaged in fraudulent practices designed to circumvent Customs related laws;

- Protecting intellectual property rights by enforcing the laws intended to prevent illegal trade practices, including provisions related to quotas; and by providing Customs Records for copyrights, patents, trademarks;

- Protecting the general welfare and security of The Bahamas by enforcing import and export restrictions and prohibitions, including money laundering.

All Customs activities are governed by the Customs Management Act 2011. In addition to our duties, The Customs Department also collect additional revenue on behalf of Civil Aviation, Ministry of Tourism, Road Traffic Department, Ministry of Agriculture and Fisheries, other Government Ministries and Departments.

SCOPE OF RESPONSIBILITY

The scope of responsibility under the Department is immense and stretches across the archipelago of the Bahamas.

Currently, there are 32 official Ports of Entry. In addition, numerous sufferance wharfs approved by the Comptroller of Customs are located throughout The Bahamas. This includes all Airports and Docks within these ports. Also, the Department controls all imports and exports from and to The Bahamas. Furthermore, Customs provides the initial protection at the borders from illegal drugs, contraband, firearms and all other prohibited and restricted goods

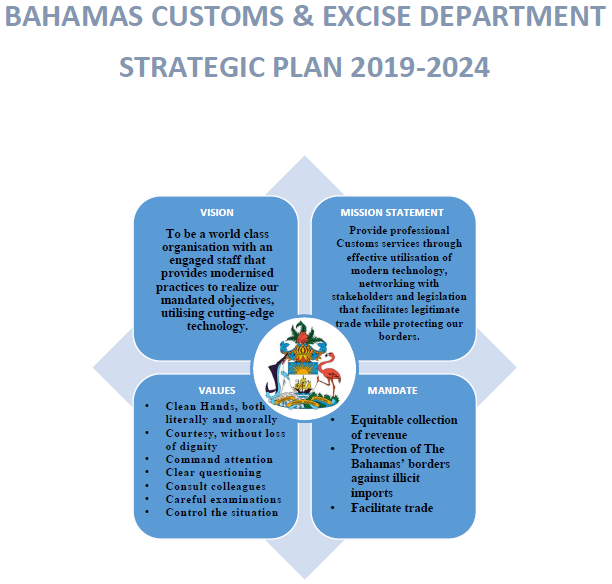

VISION

To be a world class organisation with an engaged staff that provides modernized practices to realize our mandated objectives, utilizing cutting-edge technology.

MISSION STATEMENT

Provide professional Customs services through effective utilisation of modern technology, networking with stakeholders and legislation that facilitates legitimate trade while protecting our borders.

VALUES (Seven Cs of Customs)

The seven (7) stripes represent the seven “Cs” of Customs, which is a set of moral codes that guide the individual Customs Officer:

- Clean Hands, both literally and morally

- Courtesy, without loss of dignity

- Command attention

- Clear questioning

- Consult colleagues

- Careful examinations

- Control the situation

MANDATE

- Equitable collection of revenue

- Protection of The Bahamas’ borders against illicit imports

- Facilitate trade

Ports of Entry

Abaco

Marsh Harbour

- Leonard M Thompson International Airport

- Cherokee Air

- Conch Inn Marina

- Great Abaco Beach Resort Marina

- Mangoes Marina

- Jib Room Marina

- Marsha Harbour Public Dock

- Baker’s Bay Marina, Guana Cay

Treasure Cay

- Treasure Cay Airport

- Treasure Cay Public Dock

- Treasure Cay Marina

Green Turtle Cay

- Green Turtle Public Dock

Sandy Point

- Sandy Point Airport (Upon Request)

- Sandy Point Public Dock (Upon Request)

Spanish Cay

- Spanish Cay Airport

- Spanish Cay Marina

Andros

Fresh Creek

Fresh Creek Airport

- Fresh Creek Public Dock

San Andros

- San Andros Airport

- San Andros Public Dock

Congo Town

- Congo Town Airport

- Congo Town Airport

Berry Islands

Great Harbour Cay

- Great Harbour Cay Airport

- Great Harbour Cay Marina

- Bullock’s Harbour Public Dock

Chub Cay

- Chub Cay Airport

- Chub Cay Marina

Bimini

- South Bimini Airport

- Bimini Sands Marina

- South Bimini Marina

- Big Game Marina

- Blue Waters Marina

- Brown Marina

- Resort World Marina

- Sea Crest Marina

- Weech Marina

- Resort World Sea Plane

- Bimini Public Dock

Cat Cay

- Cay Marina

Ocean Cay

- Ocean Cay Airport

- Ocean Cay Marina

Cat Island

- New Bight Airport

- Smith’s Bay Airport

- Smith’s Bay Public Dock

- Bennett’s Harbour Public Dock

- Arthur’s Town Public Dock

Eleuthera

Harbour Island

- Harbour Island Public Dock

- Harbour Island Marina

- Romora Bay Marina

- Valentines Marina

Spanish Wells

- Spanish Wells Public Dock

- Spanish Wells Yacht Haven Marina

North Eleuthera

- North Eleuthera Airport

- White Crown Aviation

Governor’s Harbour

- Governor’s Harbour International Airport

- Governor’s Harbour Public Dock

- French Leave

Rock Sound

- Rock Sound Airport

- Princess Cay (Cruise Ship)

- Half Moon Cay (Cruise Ship)

- Cape Eleuthera (Restricted)

Exuma

- Exuma International Airport

- Exuma Public Dock

- Emerald Bay Marina

- Exuma Yacht Club Marina

- Black Point

- Black Point Airport

- Black Point Public Dock

Grand Bahama

Freeport

- Grand Bahama International Airport

- Freeport Harbour

- Freeport Container Port

- Bradford Marine

- Xanadu Marina

- Running Mon Marina

- Port Lucaya Marina

- Lucayan Marina Village

- Lucayan Yacht Club

- Grand Bahama Yacht Club

East End

- South Riding Point

Grand Cay & West End

- Blue Marlin Cove Marina

- Old Bahama Bay Marina

- West End Airport (Restricted)

Inagua

- Inagua Airport

- Inagua Public Dock

Long Island

Stella Maris

- Stella Maris Airport

- Stella Maris Public Dock

- Stella Maris Marina

- Simms Public Dock

- Salt Pond Public Dock

- Clarence Town Public Dock

- Deadman’s Cay Airport

New Providence

- Lynden Pindling International Airport

- Arawak Container Port

- Prince George Dock

- East Bay Yacht Basin

- Harbour Central Marina

- Lyford Cay Marina

- Nassau Harbour Club

- Nassau Yacht Haven

- Southwest Bay Dolphins

- Kelly’s Dock

- Atlantis Marina

- Texaco Harbour View Marina

- Albany Marina

San Salvador

- San Salvador Airport

- San Salvador Public Dock

- Riding Rock Marina

Customs Offices

Nassau

The Bahamas Customs Department

P. O. Box N 155

Nassau

New Providence

The Bahamas

Location – Headquarters – University Drive

Opening Hours: 9:00 am to 4:00 pm, Monday to Friday.

Tel. (242)604-3124, 604-3125

Fax. (242)325-7409

Email: customs@bahamas.gov.bs

Lynden Pindling International Airport 604-3277/3256/3271/3263

Arawak Container Port 604-3196/3184/3187/3174/3551

Prince George Dock 604-3341

Odyssey Aviation (FBO) 604-3352/3167

Harbour Office (P.G. Dock) 604-3340 through 3347

Gladstone Freight Terminal 604-3321/3318/3313/3318/3085

Jet Aviation (Executive Flight Support) 604-2336/2337/2338

Information Technology Unit 604-3004-7/10/11/13/14/36 or 604-3133/3157/3176

Abaco

Officer in Charge – Chief Customs/Revenue Officer - Ricardo Toote

Bahamas Customs

P.O. Box - AB-20178

Tel.: Main Office 699-4034 Email: MARSHHARBOURDOCK@BAHAMAS.GOV.BS

Tel.: Public dock 699-4034

Tel.: Airport 699-4021 Email: MARSHHARBOURAIRPORT@BAHAMAS.GOV.BS

Fax 367-4050

Officer in Charge – Customs/Revenue Officer I – Bridgette Russell-Chase

Treasure Cay Abaco Airport 699-4059 Email: TREASURECAYAIRPORT@BAHAMAS.GOV.BS

Fax 365-8603

Officer in Charge – Customs/Revenue Officer - Deidre Cox

Green Turtle Public Dock 699-4045 Email: GREENTURTLECAYDOCK@BAHAMAS.GOV.BS

Fax 365-4078

Spanish Cay Airport 699-4060

Andros

Officer in Charge – Customs/Revenue Officer I – Bradlena Williams

Congo Town 369-2640 Email: CONGOTOWNAIRPORT@BAHAMAS.GOV.BS

Fax 369-2608

Officer in Charge – Customs/Revenue Officer I – Dexter Bain

Fresh Creek 368-2030 Email: FRESHCREEKDOCK@BAHAMAS.GOV.BS

Fax 368-2086

Officer in Charge – Customs/Revenue Officer I – Alfreda Sawyer

San Andros 329-2140 Email: SANANDROSAIRPORT@BAHAMAS.GOV.BS

Fax 329-2544

Bimini

Officer in Charge – Senior Customs Officer – Perry Ferguson

Main Office & Public Dock 347-3100 Email: BIMINIAIRPORT@BAHAMAS.GOV.BS,

South Bimini & Airport 347-3101

Fax 347-3466

Vibe 225-3831

Cat Cay 347-5011

Chubb Cay

Officer in Charge – Customs/Revenue Officer I – Maurice Clarke

Chubb Cay Airport 359-9020

Chubb Cay Marina 325-1490

Fax 325-7086

Cat Island

Officer in Charge – Senior Customs/Revenue Officer - Donnithorne Collie

New Bight Airport 342-2016 Email: CATISLANDCUSTOMS@BAHAMAS.GOV.BS

Fax 342-2041

Smith’s Bay Dock 342-2149

Smith’s Bay 342-2223

Vibe 225-6663

Fax 342-2150

Bennet’s Harbour on call at listed numbers

Author Town Dock on call at listed numbers

Eleuthera

Officer in Charge – Assistant Comptroller Customs – Andre Thurston

Governor’s Harbour Dock 699-6100 through 6106

332-3193 Email: GOVERNORSHARBOURDOCK@BAHAMAS.GOV.BS

Governor’s Harbour vibe 225-8214

Fax 332-2730

Governor’s Harbour Airport 332-2341

Fax 332-2645

Officer in Charge – Chief Customs/Revenue Officer – Telia Wilson-Beneby

Rock Sound Airport 699-6123/24/25/27 Email: ROCKSOUNDDOCK@BAHAMAS.GOV.BS

699-6109/12

334-2183

Fax 334-2508

Half Moon Cay on call

Princess Cay on call

Davis Cay on call

Officer in Charge – Senior Customs/Revenue Officer - Rochelle Ferguson

North Eleuthera 699-6121 Email: NORTHELEUTHERAAIRPORT@BAHAMAS.GOV.BS

699-6117

Vibe 225-3775

Fax 335-1381

White Crown 335-1654

Officer in Charge – Customs/Revenue Officer I – Patrick Gilbert

Spanish Wells 699-6128 Email: SPANISHWELLSDOCK@BAHAMAS.GOV.BS

699-6129

Officer in Charge – Customs/Revenue Officer I – Randolph Curtis

Harbour Island 699-6122 Email: HARBOURISLANDDOCK@BAHAMAS.GOV.BS

699-6147

Fax 333-3602

Exuma

Officer in Charge – Chief Customs Officer/Revenue Officer – Rhonda Thurston

Dock (Main Office) 336-2072 Email: EXUMADOCK@BAHAMAS.GOV.BS

Vibe 225-4519

Airport 345-0071 Email: EXUMAAIRPORT@BAHAMAS.GOV.BS

Fax 336-2243

Berry Islands

Officer in Charge – Senior Customs/Revenue Officer – Antanell Logan-Ottley

Great Harbour Cay Email: GREATHARBOURCAYCUSTOMS@BAHAMAS.GOV.BS

Dock 367-8566

Vibe 225-2099

Fax 367-8567

Inagua

Officer in Charge – Senior Customs/Revenue Officer – Floyd Lewis

Phone 339-1254 Email: INAGUACUSTOMS@BAHAMAS.GOV.BS

Fax 339-1883

Vibe 225-2237

Long Island (Stella Maris)

Officer in Charge – Senior Customs/Revenue Officer – Edward Hanna

Phone 338-2012 Email: STELLAMARISDOCK@BAHAMAS.GOV.BS

Vibe 225-2038

Fax 338-2017

San Salvador

Officer in Charge – Customs/Revenue Officer I – Chad Francis

Phone 331-2131 Email: SANSALVADORDOCK@BAHAMAS.GOV.BS

Vibe 226-8658

Fax 331-2431

Grand Bahama

Officer in Charge – Superintendent - Whitney Kenny 602-9400 Email: custfreeportgeneral@bahamas.gov.bs

P.O. Box F-42484

C.A. Smith Complex

East Mall Drive

Lucayan International Airport 602-9546/ Email:

Freeport Container Port 602-9503

Lucayan Harbour 602-9491

Air Freight 602-9547

West End, Old Bahama Bay 602-9413/81 Email: CUSTOMSWESTEND@BAHAMAS.GOV.BS

Walkers Cay Dock 353-1365 Email: WALKERSCAY@BAHAMAS.GOV.BS,

Walkers Cay Cell 357-6656

Grand Cay 604-3396 Email: CUSTOMSGRANDCAY@BAHAMAS.GOV.BS

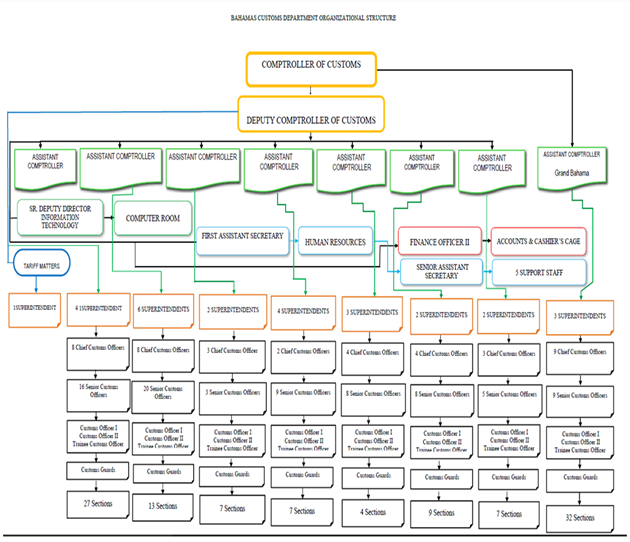

- Administration – responsible for human resources, accounts and training.

- Airports – passenger/cargo airlines

- Bonded Matters– responsible for bonded goods, goods under concession, bonds and temporary imports.

- Commonwealth Brewery – responsible for manufacturing of beverages.

- Entry Checking Section– responsible for processing of documents entering and leaving.

- Examinations Section– responsible for examination of direct delivery (containers).

- Intelligence Section– deals with risk management.

- Information Technology Unit - responsible for the department’s IT services

- Internal Audit – responsible for all audits done internally

- PCA-Post Clearance Audit – deals with post audits of declarations submitted.

- Marine Unit– deals with the patrolling of waterways and marinas.

- Canine Unit - deals with searching for contraband within shipments.

- Investigation Section – is concerned with fraud and falsification of documents.

- Queries and Refunds Section – is concerned with over / underpayment of customs duty.

- Temporary Imports – responsible for all cargo entered on a temporary basis that is going to be re-exported

- Docks – clearing inward and outwards of cargo vessels

- Parcel Post– deals with the clearing of small packages at Post Office

- Rules of Origin– deals with preferential rates from the EPA agreement

- Releasing – deals with the releasing of completed cargo

- Revenue Recovery Unit– Collections Department

- Manifest Control/Warehouse – deals with warehousing of unentered goods

- Tax Compliance – deals with the verification of approval of all Tax Compliances

- Tariff Matters – deals with HS Codes verification and rulings

- Training – mandated to train all with up to date technology and practices

- Archives – storage of completed documents

- Procurements & Logistics – purchasing department

- Valuation Section – Verification of value / prices of goods.

- Enforcement - The Investigation or Preventive Division of The Bahamas Customs Department was established to ensure compliance with the Customs Management Act 1976.

Rank Structure of Uniformed Officers

Insertion of appellate design for each rank

(Image in File “Customs Rank Structure”)

- Comptroller of Customs

- Deputy Comptroller Customs

- Assistant Comptroller of Customs

- Superintendent of Customs

- Chief Customs Officer

- Senior Customs Officer

- Chief Customs Guard

- Customs Officer Grade I

- Customs Officer Grade II

- Senior Customs Guard

- Trainee Customs Officer

- Customs Guard

| E. R. PASHLEY | 1914-1921 |

| J. H. PEET | 1921-1928 |

| HON. A. K. COLE | 1928-1946 |

| HON. S. A. ELDON | 1946-1957 |

| E. H. MCKINNEY | 1957-1968 |

| GERALD A. ISAACS | 1968-1971 |

| CALEB B. O. HEPBURN | 1972-1976 |

| J. EDISON DELEVEAUX | 1977-1985 |

| WILFRED A. HORTON | 1986-1993 |

| JOHN ROLLE | 1993-2008 |

| ANTHONY ADDERLEY | 2008-2009 |

| GLEN GOMEZ | 2009-2011 |

| CHARLES TURNER | 2012-2017 |

| DR. GEANNINE MOSS | 2017- |

Insert an updated revenue collection data information

The Bahamas has been a member of the World Customs Organization since August 16, 1974. Since becoming a member of the organization the country of benefited from technical expertise and advice from the organization.

The Bahamas has been a member of the World Customs Organization since August 16, 1974. Since becoming a member of the organization the country of benefited from technical expertise and advice from the organization.

The World Customs Organization (WCO), established in 1952 as the Customs Co-operation Council (CCC) is an independent intergovernmental body whose mission is to enhance the effectiveness and efficiency of Customs administrations.

Today, the WCO represents 183 Customs administrations across the globe that collectively process approximately 98% of world trade. As the global centre of Customs expertise, the WCO is the only international organization with competence in Customs matters and can rightly call itself the voice of the international Customs community.

The WCO’s governing body – the Council – relies on the competence and skills of a Secretariat and a range of technical and advisory committees to accomplish its mission. The Secretariat comprises over 100 international officials, technical experts and support staff of some nationalities.

As a forum for dialogue and exchange of experiences between national Customs delegates, the WCO offers its Members a range of Conventions and other international instruments, as well as technical assistance and training services provided either directly by the Secretariat, or with its participation. The Secretariat also actively supports its Members in their endeavors to modernize and build capacity within their national Customs administrations.

Besides the vital role played by the WCO in stimulating the growth of legitimate international trade, its efforts to combat fraudulent activities are also recognized internationally. The partnership approach championed by the WCO is one of the keys to building bridges between Customs administrations and their partners. By promoting the emergence of an honest, transparent and predictable Customs environment, the WCO directly contributes to the economic and social well-being of its Members.

Besides the vital role played by the WCO in stimulating the growth of legitimate international trade, its efforts to combat fraudulent activities are also recognized internationally. The partnership approach championed by the WCO is one of the keys to building bridges between Customs administrations and their partners. By promoting the emergence of an honest, transparent and predictable Customs environment, the WCO directly contributes to the economic and social well-being of its Members.

Finally, in an international environment characterized by instability and the ever-present threat of terrorist activity, the WCO’s mission to enhance the protection of society and the national territory, and to secure and facilitate international trade, takes on its full meaning.

Recently, The Bahamas Customs Department has taken full advantage of the developing relationship with the WCO. On March 22nd, 2018, a WCO training program was launched by the Bahamas Customs & Excise Department. The Program, funded by the Inter-American Development Bank, consists of 26 missions over a two-year period and comprises of three components: organizational development, human resources and governance. Thus far, courses such as Gulf CBR and Data Modeling have been offered. As the Bahamas aims to join the World Trade Organization (WTO) within two years, this Program is also intended to prepare the country for WTO accession.

Excerpt from www.wcoomd.org/en/about-us/what-is-the-wco.aspx

ABOUT THE CCLEC

The Caribbean Customs Law Enforcement Council (CCLEC) is a multilateral regional organization dedicated to improving the overall professionalism of its members.

The CCLEC was established in the early 1970s as an informal association of Customs administrations within the Caribbean region. The principal objectives of the Council in these early years were the exchange of information on smuggling and helping the smaller regional administrations adjust to the new threat of organized drug trafficking through the region.

From these early beginnings the Council slowly established itself through a growing membership base and an increasing diversification into other areas of Customs business.

In 1989, the members of the Council agreed to formalize their exchange of information through the adoption of a Memorandum of Understanding (MOU) regarding mutual assistance and cooperation for the prevention and repression of customs offenses in the Caribbean zone. At that time 21 countries signed the MOU but this number has grown to 36 signatories.

The CCLEC comprises 38 Customs Administrations of which 36 are signatories to the CCLEC Memorandum of Understanding.

The Membership comprises Customs administration from the Caribbean and Latin America as well as Canada, France, the Netherlands, Spain, the United Kingdom and the United States of America.

The authority for directing the activities of CCLEC rests with the Council. An Executive Committee (EXCO), elected by the Council, makes program recommendations to the Council.

In 1995, the Government of St Lucia and CCLEC signed an agreement for the establishment of a Permanent Secretariat in St. Lucia and in 2008 the status of international organization was conferred on CCLEC by the Government of St Lucia.

The Permanent Secretary and supporting staff are responsible for the day-to-day management of CCLEC.

CCLEC SIGNS TREATY TO ESTABLISH THE CCO

The CCLEC 41st Conference was held in Havana, Cuba on May 22-24, 2019 under the theme

‘The Pathway to Success: Strength through Unity’. This event was marked by the historical signing of the treaty which will establish the Caribbean Customs Organization (CCO).

The signing ceremony was attended by high level government officials including, on behalf of the Kingdom of the Netherlands, Mr Menno Snel, Minister for Finance of Taxation and Customs of the Netherlands, Mrs Xiomara Ruiz-Maduro, Minister of Finance, Economic Affairs and Culture of Aruba, Mr Kenneth Gijsbertha, Minister of Finance of Curacao, and Mr Cornelius de Weever, Minister of Justice of Sint Maarten, who all signed for their respective countries. Ambassador to Cuba, Mr Andrew Brent, signed on behalf of the Bahamas, and Mr Antony Stokes, UK’s Ambassador to Cuba, signed on behalf of Anguilla, Bermuda, the Cayman Islands, Montserrat, and the Turks and Caicos Islands. Representatives from Customs, Mr Raju Boddu, Comptroller of Customs for Antigua, Mr Nelson E. Cordovés Reyes, Head of Customs for Cuba, Mr Cesar Zorrilla, Manager of the Technical Deliberative Department of the General Customs Directorate for the Dominican Republic, and Mr Fritz Alcindor, Deputy Director General of Haiti signed on behalf of their respective governments.

After three decades of operating under an MOU, members of the Caribbean Customs Law Enforcement Council (CCLEC) agreed that it was of paramount importance, given the opportunities and challenges presented by technological advancements, to formalize the legal basis for sharing information. The MOU to establish the CCLEC was signed in 1989, an MOU which, although not legally binding, served the organization in meeting its objectives to improve the overall professionalism of its members through cooperation, sharing of best practices, human resource development, modernization, automation, harmonization of processes and procedures and information/intelligence sharing. However, global security challenges, the need for automatic sharing of information and the advent of several new trade arrangements means that the CCLEC’s role will become more complex. To this end, the need for a more robust legally binding mechanism to improve information and intelligence exchange was necessary.

The CCO treaty will provide the legal gateway for members to share information not only amongst themselves but with other regional and international law enforcement agencies.

Twenty-five member countries were in attendance to witness this historical event as well as several regional and international organisations.

Articles referenced from the Official Website

For further information, visit their website here

The World Trade Organization — the WTO — is the international organization whose primary purpose is to open trade for the benefit of all. There are a number of ways of looking at the World Trade Organization. It is an organization for trade opening. It is a forum for governments to negotiate trade agreements. The WTO can –

1 ... cut living costs and raise living standards

2 ... settle disputes and reduce trade tensions

3 ... stimulate economic growth and employment

4 ... cut the cost of doing business internationally

5 ... encourage good governance

6 ... help countries develop

7 ... give the weak a stronger voice

8 ... support the environment and health

9 ... contribute to peace and stability

10 ... be effective without hitting the headlines

The Bahamas obtained observer status to get acquainted with the WTO and its workings in 2000. By becoming an observer it allowed The Bahamas to become acquainted with the rules and procedures of the World Trade Organization. In 2001 an application was made to apply for full membership. There was a delay in the accession process however in 2017 the country has resume its membership application by fulling the necessary. The Government of the Bahamas aims to be in a position to accede by early 2019.

The WTO is run by its member governments. All major decisions are made by the membership as a whole, either by ministers (who usually meet at least once every two years) or by their ambassadors or delegates (who meet regularly in Geneva). The WTO agreements are lengthy and complex because they are legal texts covering a wide range of activities. But a number of simple, fundamental principles run throughout all of these documents. These principles are the foundation of the multilateral trading system.

The WTO agreements cover goods, services and intellectual property. They spell out the principles of liberalization, and the permitted exceptions. They include individual countries’ commitments to lower customs tariffs and other trade barriers, and to open and keep open services markets. They set procedures for settling disputes. These agreements are not static; they are renegotiated from time to time and new agreements can be added to the package. Many are now being negotiated under the Doha Development Agenda, launched by WTO trade ministers in Doha, Qatar, in November 2001.

WTO agreements require governments to make their trade policies transparent by notifying the WTO about laws in force and measures adopted. Various WTO councils and committees seek to ensure that these requirements are being followed and that WTO agreements are being properly implemented.

The WTO’s procedure for resolving trade quarrels under the Dispute Settlement Understanding is vital for enforcing the rules and therefore for ensuring that trade flows smoothly. Countries bring disputes to the WTO if they think their rights under the agreements are being infringed. Judgements by specially appointed independent experts are based on interpretations of the agreements and individual countries’ commitments. It is a place for countries to settle trade disputes. It operates a system of trade rules. Essentially, the WTO is a place where member governments try to sort out the trade problems they face with each other.

WTO agreements contain special provision for developing countries, including longer time periods to implement agreements and commitments, measures to increase their trading opportunities, and support to help them build their trade capacity, to handle disputes and to implement technical standards. The WTO organizes hundreds of technical cooperation missions to developing countries annually. It also holds numerous courses each year in Geneva for government officials. Aid for Trade aims to help developing countries develop the skills and infrastructure needed to expand their trade.

Excerpt from www.wto.org/english/thewto_e/whatis_e/what_we_do_e.htm

The Bahamas signed the EPA in October 2008. The EU and the signatory CARIFORUM States (including The Bahamas) have been provisionally applying the Agreement since 29th December 2008; however, it came into effect on 1st July, 2013.

Under the EPA, importers can take advantage of preferential tariff rates on product originating out of the EU, and CARIFORUM countries. The implementation of an EPA tariff was specifically designed to reduce tariffs progressively over a period extending to 25 years, at which time duties are expected to be completely eliminated.

Traders wishing to take advantage of the reduced rates, must have their goods accompanied by the certificate of origin/EUR.1 form

Economic Partnership Agreement (EPA)

- The Economic Partnership Agreement (EPA) entered into between the CARIFORUM States and the European Union (EU) and its member States provides, inter alia, for a trade partnership between the Signatory States aimed at the expansion of their trade and, from the particular standpoint of the CARIFORUM States, promoting the economic development of these States. The Agreement recognizes the on-going commitment of the CARIFORUM States to the furtherance of their development through the regional and sub-regional integration initiatives upon which they are embarked. These initiatives are an essential link in the strategy, to be enhanced by the EPA, toward their greater participation in world trade.

- The EPA creates a reciprocal preferential trade arrangement tailored to the emerging trade relations of the CARIFORUM States and the EU Member States. The market access arrangement provide for the immediate duty-free and quota free entry into the markets of the EU member States of goods originating in CARIFORUM States. Reflecting the unequal levels of development of the Member States of the EU on the one hand and the CARIFORUM States on the other, the Agreement prescribes an asymmetrical and more measured rate of liberalization of access “goods originating” refers to products which meet the qualifying criteria set down in the rules of origin prescribed under the Agreement. The EPA rules of origin, which are to be found in Protocol 1, which is an integral part of the Agreement, are examined in a separate publication.

- This publication explains the nature and scope of the tariff liberalization provisions of the Agreement governing trade in goods between the CARIFORUM states and the Member States of the EU. It describes the market liberalization obligations of the Signatory States, with particular emphasis on the provision for the phased reduction by the CARIFORUM States of customs duties applicable to imports of goods originating in the Member States of the EU.

- The CARIFORUM-EU EPA which was signed in October 2008 by fourteen CARIFORUM States and by the fifteenth CARIFORUM State, Haiti, in December 2009 has been provisionally applied since 29th December 2008.

- Some goods are entirely excluded from the trade liberalization regime. Among the excluded goods are a range of products of the agriculture sector, examples of which are mean and fish products, tomatoes and cucumbers, bananas and plantains, mangoes, pineapples, citrus fruit, fruit juices, tomato ketchup; and aerated and alcoholic beverages. Other products excluded from market access liberalization include non-electric water heaters (other than gas-operated), refrigerators and freezers, and gold jewelry. For some goods, CARIFORUM States have agreed to apply zero rates. In many cases, zero rates apply to gods from all sources, but for some additional goods zero rates are also applied where those goods are traded under the EPA.

- The Customs duties on all other goods imported by CARIFORUM States the EPA will be subject to phased reduction.

- The EPA defines customs duty as any duty or charge of any kind, including any form of surtax or surcharge, imposed in connection with importation or exportation of goods. This definition, which effectively captures all border taxes, excludes the following –

- Internal taxes or other internal charges where these are also applied on like domestic products and are not in excess of those taxes or charges applied to domestic products;

- Fees or other charges imposed for services rendered that are commensurate with the cost of such services; and

- Anti-dumping and countervailing duties and tariff-based safeguard measures implemented in the special circumstances of trade defense action.

(Excerpt taken from CARIFOM EPA Brouchure)